Emissions trading: €21 billion channeled into the Climate and Transformation Fund

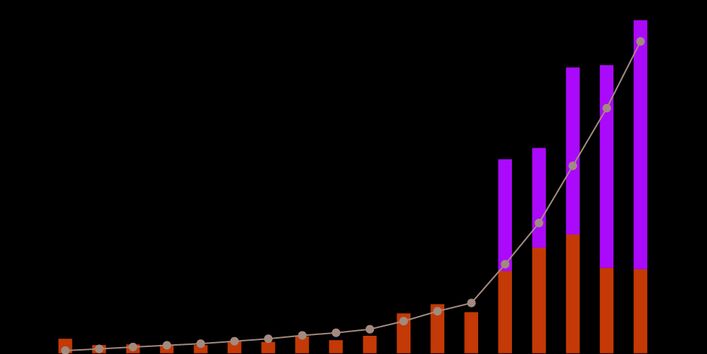

Revenue from the European and the national emissions trading systems in Germany totaled €21.4 billion in 2025. Revenues from these two central market-based climate policy instruments were thus well above the previous year’s result (€18.5 billion). This was reported by the German Emissions Trading Authority (DEHSt) at the German Environment Agency (UBA). All proceeds are paid in full into the Climate and Transformation Fund (KTF), which plays a central role as a financing instrument in achieving Germany’s energy and climate policy objectives.

“Emissions trading has developed into the central cross-sector climate policy instrument. In combination with other effective measures, carbon pricing provides crucial momentum for the climate-friendly transformation of our society”, said UBA President Dirk Messner. “Revenue from emissions trading plays an indispensable role in this process: It is channeled into climate protection programmes, such as energy-efficient building refurbishment, the decarbonisation of industry, and the expansion of renewable energy, electric mobility, and charging infrastructure. In this way, emissions trading creates the necessary balance between ambitious climate action, social fairness, and economic competitiveness. These principles must be consistently taken into account in the upcoming negotiations on the reform of European climate policy for the period up to 2040, and also with regard to German climate policy.”

The European Emissions Trading System (EU ETS 1) covers greenhouse gas emissions from energy and energy-intensive industrial installations, intra-European aviation, and maritime transport. In 2025, auction revenues under EU ETS 1 amounted to around €5.4 billion, slightly below the previous year’s level (€5.5 billion in 2024). By contrast, revenue from carbon pricing under the national emissions trading system (nEHS) for heating and transport rose significantly compared with the previous year. In 2025, nEHS revenues reached around €16 billion, approximately 23 per cent higher than in 2024 (€13 billion). Overall revenues from emissions trading therefore rose noticeably compared to the previous year.

EU ETS 1: EUA price increase and lower auction volumes compared with 2024

Under EU ETS 1, the number of emission allowances (EUAs) issued each year is gradually reduced in order to progressively tighten the emissions cap. Auction volumes were further reduced in 2025, reflecting the European reform adopted in 2023 to strengthen emissions trading. Specifically, the number of EUAs auctioned for Germany fell to 73.5 million in 2025, compared with 85 million in 2024. Auctions are conducted on the European Energy Exchange (EEX) in Leipzig on behalf of the UBA.

At the same time, market developments led to a rise in the average auction price for EUAs. In 2025, the average price stood at around €74 (€73.86), above the previous year’s level (€65 in 2024). Price levels in EU ETS 1 therefore remained significantly higher than in the national system, where the price was €55.

nEHS: price increase and stable sales volumes

Germany introduced the nEHS for heating and transport in 2021 as a complement to EU ETS 1. Initially, until 2022, the system covered only the main fuels such as petrol, diesel, heating oil, liquefied petroleum gas and natural gas. From 2023 onwards, all other fuels, including coal, were added. Since 2024, CO2 emissions from waste incineration plants have also been included.

In 2025, a total of around 277 million nEHS certificates were sold at a fixed price of €55 per certificate, generating revenues of more than €15.2 billion. The sales were conducted on the European Energy Exchange (EEX) on behalf of the German Environment Agency (UBA). A further roughly 17 million nEHS certificates were sold under the limited option to purchase additional certificates at the previous year’s fixed price (€45 per nEHS certificate), corresponding to revenues of approximately €770 million. Total nEHS revenues from the sale of approximately 294 million nEHS certificates thus amounted to around 16 billion euros in 2025.

New price corridor for emission certificates from 2026

As sales volumes of nEHS certificates in 2025 remained largely unchanged while the fixed price increased from €45 to €55, revenues rose significantly (2024: 295 million nEHS certificates with vintage years 2024 and 2023, generating around €13 billion). In 2026, nEHS certificates will be auctioned for the first time within a price corridor with a floor price of €55 and a ceiling price of €65. From 2028 onward, the nEHS will be largely replaced by the European Emissions Trading System for fuels (EU ETS 2), which was adopted in 2023.

“The high sales volumes in the nEHS reflect emission levels in the buildings and transport sectors that are clearly too high in view of the climate targets. The climate policy imperative in these sectors is enormous,” says Christoph Kühleis, Acting Head of the division “Climate Protection, Energy, German Emissions Trading Authority” at the UBA. “EU ETS 2 has the potential to become a key driver of a European modernisation agenda in this area. It increases the economic viability of climate-friendly technologies while at the same time creating scope for targeted social compensation measures.”

The DEHSt at the German Environment Agency (UBA) is responsible for implementing the national emissions trading system, the European emissions trading system and, since December 2023, the European Carbon Border Adjustment Mechanism (CBAM) in Germany. DEHSt also serves as the direct supplier of EUAs and nEHS certificates for Germany on the primary market of the Leipzig-based European Energy Exchange (EEX). The EEX sells and auctions EUAs and nEHS certificates on behalf of the German Environment Agency (UBA).