Climate change, with all its associated consequences, entails substantial damage to the national economy and confronts some companies with major challenges. Owing to climate change, their business activities are exposed to a variety of risks. Temporary or transition-related risks arise for companies from the pressure for action resulting from climate-related changes in terms of political and legal framework conditions, new technological challenges and increasing social expectations. If they fail to assess the changed market environment correctly, if they don’t respond fast enough or if they lack flexibility to engage in co-designing the transition to sustainable management, this can inflict considerable commercial losses on them. Other relevant risks include physical risks that can result from extreme weather and weather-pattern events or creeping environmental changes. Potential impacts include for instance productivity losses, damage to buildings, changes in demand or adverse effects on supply chains (cf. Indicator IG-R-2, VE-I-1 and VE-I-2).

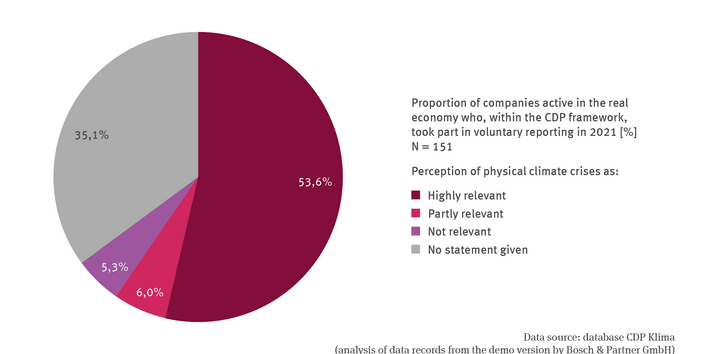

Not just the world of politics and society, but also the world of finance and the capital markets – which provide companies with equity capital or borrowed capital – are keen on being able to assess the stability of companies. For this purpose, it is increasingly relevant to companies to be aware of any climate-related risks and to implement preventative measures (cf. Indicator FiW-R-1). The CDP (formerly Carbon Disclosure Project) began 20 years ago to set up a database with information on companies’ climate-related burdens. The information is supplied by companies on a voluntary basis. While initially the focus was on reporting climate-damaging greenhouse gas emissions, by now other environmental impacts are added to the database including information from companies active in the water industry and in the forestry sector. For the sub-database on climate (abbreviated to CDP-Klima) companies are asked to supply, on an annual basis, statements on greenhouse gas emissions, physical and transitory climate risks and on organisational arrangements for precautionary measures. In 2021 151 companies also provided statements – within the framework of their voluntary participation in CDP – on how they rated the physical climate risks to their business activities. This included 23 companies that are part of the DAX-40 group as well as other larger and medium-sized enterprises. More than half of them rated the physical climate risk as highly relevant, compared to just 5 % that reckoned they were not relevant. The higher the proportion of companies rating physical climate risks as relevant, the higher is presumably the probability that those companies will make efforts to mitigate the material physical risks.

Nevertheless, the 2021 CDP findings should not be considered representative of German companies in general. On one hand, it is only a minor number of companies that takes part in reporting. On the other, it can be assumed that the outcomes of the survey overestimate the general perception of physical risks, because the companies that submit voluntary reports to CDP presumably engage more strongly with the issues concerned than those who do not participate in CDP. Moreover, there are presumably variations from sector to sector, that are not taken into account in this context. For example, companies that generate or process agricultural raw materials are likely to be exposed more strongly to physical climate risks than for instance software businesses. There are other studies, however, which have worked with larger data pools and still arrived at basically similar findings.186 186 According to these findings, physical risks are not categorically overlooked, but most companies examining climate-related risks perceive the greater risks to be involved in the transition to a CO2-poor or CO2 neutral economy.

In view of the economic risks that can arise from inadequate risk awareness and lack of appropriate preventative measures, the Federal government is very keen on making every effort in continuing to raise companies’ awareness of these risks. Clear regulations pertaining to companies’ obligations for reporting and the submission of declarations can make a useful contribution to these endeavours. Since the middle of the 2010s, the ‘Financial Stability Board’ (FSB) has been working for the G20. The FSB has set up the Task Force on Climate-related Financial Disclosures (TCFD) which is composed of experts from the real and financial economies. In 2017, the TCFD submitted recommendations to make the reporting mandatory in future – including issues such as governance; in other words, regarding competencies among board members and individuals at the highest executive level – in respect of climate-related matters and risk management.187 The TCFD recommendations were adopted at EU level. Consequently, the ‘Corporate Social Responsibility’ directive (CSR Directive) – in existence since 2014 – was comprehensively revised and enhanced in 2022 under the title of ‘Corporate Sustainability Reporting Directive – CSRD’. This process resulted in distinctly expanded non-financial reporting obligations imposed on companies and on the circle of individuals with reporting responsibilities. Reporting obligations come into force starting with the beginning of the 2025 business year and are applicable to all major companies with at least 250 employees, and – starting with the beginning of the 2026 business year – also to small and medium enterprises (SMEs) listed on the stock exchange.

The CSR Directive or rather the new CSRD is closely bound up with the EU Taxonomy Regulation which has been in force since 2020. Consequently, companies active in the real economy will have to state – as they are obliged to report under the CSR Directive or rather the future CSRD – in their non-financial declarations, which proportions of their turnover, their investment expenditure and certain operating expenses are related to their taxonomy-compliant economic activities. Associated with this is also the requirement to carry out a systematic climate risk and vulnerability analysis relating to these economic activities.

It is to be expected that in future, as a result of the extended reporting obligations, in future risk awareness and prevention in respect of climate risks will be improved across the entire company. Furthermore, the disclosure regulations might help to improve data availability thus making it possible to further develop the indicator described in this context.

186 - Lautermann C., Young C., Hoffmann E. 2021: Klima- und Umweltberichterstattung deutscher Unternehmen Evaluierung der CSR-Berichtspflicht für die Jahre 2018 und 2019. Dessau-Roßlau, 59 pp. https://www.umweltbundesamt.de/publikationen/klima-umweltberichterstattung-deutscher-unternehmen

186 - Loew T., Braun S., Fleischmann J., Franz M., Klein A., Rink S., Hensel L. 2020: Management von Klimarisiken in Unternehmen: Politische Entwicklungen, Konzepte und Berichtspraxis – Teilbericht im Rahmen des UBA FKZ 3719 48 1030. Climate Change 02/2021, Dessau-Roßlau, 155 pp. https://www.umweltbundesamt.de/publikationen/management-von-klimarisiken-in-unternehmen

187 - TCFD – Task Force on Climate-related Financial Disclosures 2017: Recommendations of the Task Force on Climate-related Financial Disclosures. Final Report. Basel, 66 pp. https://www.fsb-tcfd.org/wp-content/uploads/2017/06/FINAL-2017-TCFD-Report-11052018.pdf