By now, taking out homeowners insurance for storm an hailstone damage has become almost a matter of course. Likewise, the conclusion of insurance contracts for other extreme natural hazards such as heavy rain and floodwater is also catching on. As far as these hazards are concerned, an increase is to be expected in view of climate change. Moreover, heavy rain events can occur regardless of location (cf. Indicator BAU-I-4). Likewise, damage to real estate or household effects can happen to anyone. In past cases of damage, both private individuals and traders who incurred the damage, have received government and non-government aid, for instance after the flooding events affecting the rivers Elbe and Danube in May and June 2014. The flooding caused damage amounting to more than 8.2 billion Euros in total for damage caused to public infrastructures, the industrial economy and private households. Not all of these were insured (cf. Indicator BAU-I-5). For damage repair and reconstruction work, a joint fund was set up by the Federal Government and the Länder Governments, entitled ‘Aufbauhilfe’ (Reconstruction Aid) with a volume of 8 billion Euros. In the period to 2021, approximately 500 million Euros from this fund were spent on the refurbishment of damaged residential buildings and on the replacement of damaged or destroyed building components. After the 2021 flooding disaster in the Rhineland-Palatinate and in North Rhine-Westphalia, the Federal Government and the Länder (Federal States) made available emergency aid amounting to approximately 770 million Euros. For reconstruction work in the floodwater regions, Federal Government added a reconstruction fund, up to 30 billion Euros of which was made available from the specially established fund ‘Aufbauhilfe 2021’ (Reconstruction Aid 2021). For the support of private households and housing associations some 1.5 billion Euros of this were either assigned or expended in the meantime.

In view of the considerable government expenditure which is spent repeatedly on flooding aid, governments and society have a keen interest in appropriate personal provision made by homeowners and tenants in an attempt to reduce government aid as much as possible. The state is unable to ensure that in cases of damage, all private damage incurred is covered. Moreover, there are legal obligations for private provision: According to the WHG (Federal Water Act), whoever might become affected by floodwater, will have to make precautionary provisions well in advance of such risk materialising150. Alongside structural improvements to the prevention or reduction of ensuing damage (cf. Indicator BAU-R-3), private provisions include making sure that adequate insurance cover in place.

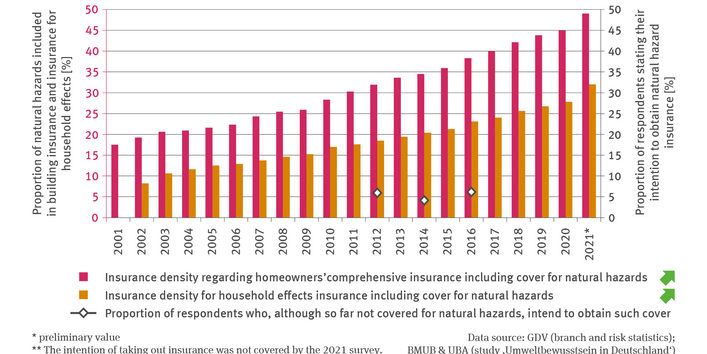

Damage from natural hazards such as flooding as a result of heavy rain and floodwater, snow pressure, avalanches or even landslides, subsidence and earthquakes – so-called damage from natural hazards – can be insured against by taking out extended natural hazard insurance (eEV). This type of insurance has become an established product in the insurance market. However, by late 2021 only 49 % of residential buildings in Germany were covered by this type of insurance (eEV). As far as tenants are concerned, it is relevant to conclude insurance policies covering household effects for damage caused by natural hazards, because damage to buildings – caused by natural hazards, especially if this damage occurs in rooms at ground level or in cellars or souterrains – can also be caused to a tenant’s household effects. By the end of 2021, 32 % of all insurance policies for household effects incorporated cover for damage from natural hazards. Nevertheless: Since 2001, both types of insurance policies have experienced a continuous and significant increase in terms of insurance density. Presumably in response to the flooding disaster in the Ahr and Erft valleys, this density experienced another distinct boost in 2021.

Notwithstanding this increase, it is not clear whether the awareness of the need for eEV cover is deeply enough engrained in the population’s consciousness. For instance, in 2016, as part of a population survey entitled ‘Environmental Awareness in Germany’ (Umweltbewusstsein in Deutschland) – the last year in which this question was asked – just under 6 % of respondents answered that although they had not yet concluded an eEV policy, they would like to conclude such an insurance policy in the future151. In the past, extreme events only ever resulted in a short-term increase in the population’s willingness to take out insurance. Generally speaking, the hazards are underestimated by the public, and their knowledge regarding which kind of damage is actually covered by an insurance policy, is woefully inadequate. It is interesting to note that underwriters are actually in a position to insure almost any buildings and homes in Germany and, most of them would also be able to offer cover for natural hazards at affordable prices. Exceptions are only made in respect of a few areas where the hazards are particularly great. But even in those cases, individual insurance solutions can be found, i.e. by incorporating high elements of ‘excess’ (a pre-determined amount deducted from the total settlement received by the claimant) and higher, risk-congruent insurance premiums.

In many Federal States (Länder), joint campaigns and initiatives were fielded in terms of politics, associations, the insurance sector and consumer protection in order to strengthen personal provisions for buildings and building contents by means of eEV in view of the expected increase in extreme weather events. After the floodwater disaster of 2021 in the Ahr and Erft valleys, discussions on legal measures for a wider distribution of eEV and even a legal obligation for taking out insurance gained impetus once more. However, a legal obligation to take out insurance cover remained as controversial as before.152 152 Nevertheless, even in the absence of such a legal obligation it would be possible to promote eEV coverage, for instance by means of lowering the tax rate for the extended insurance cover for damage from elementary hazards or by means of the opportunity to reduce insurance costs by taking personal precautionary measures. At the same time, this would give incentives for strengthening the extent of personal provisions.

Irrespective of any insurance cover, all citizens ought to protect themselves by making targeted provisions for potential damage. For its part, the state sector is obliged to enhance the building law ensuring that hazardous areas are kept effectively free from new building projects in future (cf. Indicator RO-R-6).

150 - WHG – Gesetz zur Ordnung des Wasserhaushalts. In der Fassung vom: 31. Juli 2009 (BGBl. I S. 2585), zuletzt geändert durch Artikel 1 des Gesetzes vom 4. Januar 2023 (BGBl. 2023 I Nr. 5).

151 - BMUB & UBA – Umweltbundesamt (Hg.) 2017: Umweltbewusstsein in Deutschland 2016. Ergebnisse einer repräsentativen Bevölkerungsumfrage. Bundesministerium für Umwelt, Naturschutz, Bau und Reaktorsicherheit, Umweltbundesamt. Berlin, Dessau-Roßlau, 88 pp. https://www.umweltbundesamt.de/publikationen/umweltbewusstsein-in-deutschland-2016

152 - Groß C., Wagner G. G., Leier B. 2022: Versicherungspflicht gegen Naturgefahren. Neue Entwicklungen, Verfassungskonformität und Akzeptanz in der Bevölkerung. Berlin: Sachverständigenrat für Verbraucherfragen. https://hdl.handle.net/21.11116/0000-000A-0DB7-A

152 - Haße C., Abeling T., Baumgarten C., Burger A., Rechenberg J. 2021: Klimaresilienz stärken: Bausteine für eine strategische Klimarisikovorsorge. Umweltbundesamt (Hg.), Dessau-Roßlau, 9 pp. https://www.umweltbundesamt.de/publikationen/klimaresilienz-staerken-bausteine-fuer-eine